Table Of Content

The housing market has been one of the sectors seen as leading the U.S. economic recovery amid the coronavirus pandemic, which caused widespread shutdowns throughout March and April. Existing home sales rose more than 20 percent in June, according to the National Association of Realtors, with growth throughout major regions of the U.S. If you’re not sure what type of mortgage you might qualify for, focus on rates for the most popular type of mortgage, the 30-year fixed-rate conventional loan.

Higher mortgage rates weigh on US new home sales in October - Reuters

Higher mortgage rates weigh on US new home sales in October.

Posted: Mon, 27 Nov 2023 08:00:00 GMT [source]

Typical home price in New Jersey: $491,161 (144% of typical U.S. price)

With a median household income 10% higher than the national median, homes there are relatively affordable. Illinois homes are priced well below the typical U.S. home and are among the most affordable in the country, due to the median household income there being slightly above the U.S. median. A single-family home in Arizona is expensive -- 22% more than that typically found in the U.S. Buying a home in Arizona is probably not the most affordable option, given that the median household income in the state is in line with the national median. New York state’s real estate prices are heavily influenced by New York City. And while NYC’s reputation for being notoriously expensive is certainly justified — the median price in Manhattan is more than $1.3 million, per Redfin — there is much more to this huge state than just NYC.

Higher rates, $600,000 median price return for Reno homebuyers

With the median household income in Maine at 7% below the national median, the state's income-to-home-value ratio is below average. The median home sales price is $417,700 as of the fourth quarter of 2023. That's a 37% increase from the first quarter of 2020, when the median was $329,000. The cost of living in California is notoriously high, and housing costs are a big driver of those elevated expenses. Of course, you get what you pay for, and to many, a Pacific coast getaway or desert retreat is worth the price. Remember, though, that this state is massive, and while you probably won’t find a bargain in, say, Malibu, the California housing market has plenty of budget-friendly options too, particularly inland.

Data

One proposal that might help the affordability crisis is social housing. The U.S. median home price was $412,000 in September 2023, according to Redfin. High or low home prices don't mean much in a vacuum - and that includes measures that include things such as "multiple of income". The tool automatically checks for updates from the FHFA (home prices) and Bureau of Labor Statistics (CPI) once a week. Depending on the data release, it will only be a maximum of one week out of date with those series.

Home Price-to-Income Ratio Reaches Record High - Joint Center for Housing Studies

Home Price-to-Income Ratio Reaches Record High.

Posted: Mon, 22 Jan 2024 08:00:00 GMT [source]

Typical home price in Arkansas: $196,181 (57% of typical U.S. price)

According to data from the National Association of Realtors, the median price for an existing home — one that’s already standing, not new construction — was $387,600 as of November 2023. All cities in the index reported annual price increases, with four cities—San Diego as well as Los Angeles (8.7%), Washington D.C. San Diego continued to report the highest price hike, at 11.4% from last year, followed by Chicago and Detroit, which saw an 8.9% rise, while Portland recorded the slowest annual increase at 2.2%. With more than 40,000 people in 2.54 square miles, Vermont Square’s density means you won’t get a house on an acre, but there’s always something for sale. Fixer-uppers start at $600,000, and something move-in ready will usually add $100,000 to the asking price.

Typical home price in Arizona: $417,233 (122% of typical U.S. price)

If you’re wondering whether you should buy a house now, or wait in the hopes that prices might come down significantly, you could be out of luck. November’s price tag reflected a year-over-year increase of 4 percent and marked the fifth straight month of year-over-year price jumps. The housing market tends to follow the law of supply and demand, and since there isn’t enough supply to match demand, home prices are looking fairly resilient. New single-family home sales increased 8.8% to a 693,000 annual pace last month, the fastest since September, government data showed Tuesday. Sales rose in all four regions, and the rate of purchases exceeded most estimates in a Bloomberg survey of economists. Despite rising mortgage rates, home prices soared to a new record in February, driven by strong demand and a limited housing supply—according to the S&P Case-Shiller Home Price Index released Tuesday.

The area with the second-highest rate of price increases—Coralville—is another story. Pennsylvania has affordable homes, with the typical home price being 74% of the national value and the median household income being almost even with the national median. For a look at house prices in each state, the median income by state, and housing affordability, read on. The Federal Reserve only provides data on home sales prices and does not include state-level data. The ZHVI isn't an average, but it represents the typical home value in a given area.

In September 2023, 35.5% of homes sold above their listing prices, according to Redfin. That said, a low median home price doesn’t make Ohio immune to the affordability challenges plaguing most parts of the United States. Between 1980 and 2020, the median home sales price increased by 416%.

Median sales price of new homes sold in the U.S. 1965-2023

By comparison, the median U.S. home price in June 2023 was $426,056, according to Redfin. If you want to know how much homes typically cost in a location, you can look at the average sale price or median sale price. Surprisingly, three of the top 10 counties nationwide where wages are growing faster than home prices—Los Angeles, San Bernardino and Riverside—can also be found in the state. The Ascent also has a mortgage calculator that can help you figure out mortgage payments. You can also try out our house affordability calculator to help you determine how much real estate you can afford.

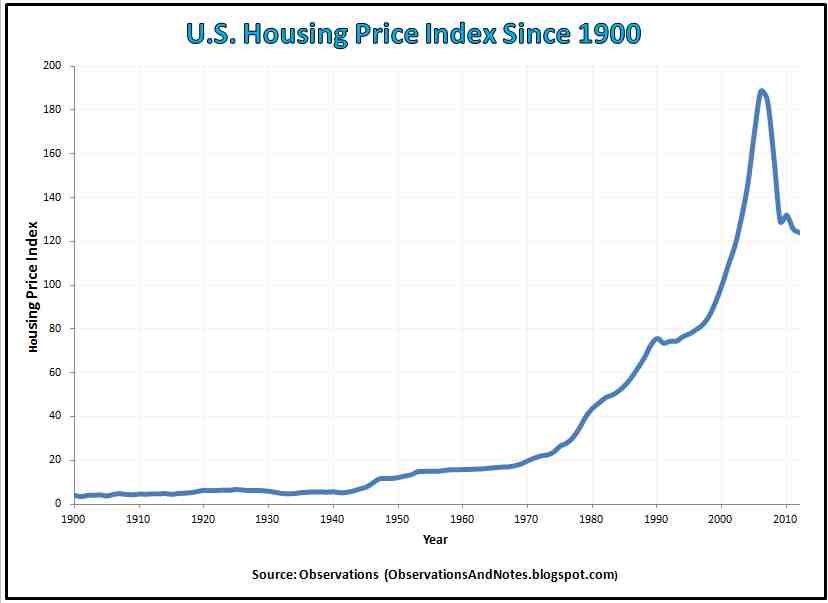

Homeownership rates also count people who bought a home already and currently live in it. Find my historical home price series using nominal prices and one adjusted for inflation. The tool automatically checks for data updates weekly, but due to report release cadence, the data lags behind (by a few months).

Homes in Colorado are the sixth most expensive in the nation, and the state has the eighth-lowest income-to-home-value ratio, despite the median household there being 19% above the national average. That's offset by the median income in Alaska being 18% above the national median. That familiar cheer from the crowd at Ohio State University football games isn’t just for touchdowns anymore; it’s for a housing market that feels like a win for anyone on a tight budget. The Buckeye State offers a balance of big cities like Cincinnati, Columbus and Cleveland with many smaller towns in-between.

Mississippi cracked the top five of Bankrate’s most recent ranking of best states to retire in, and its affordable housing is a big reason why. Combine that with temperate weather, rich history and Gulf coastline, and it’s no wonder more people are discovering this Southern state. A drive east down the 210 Freeway past Pasadena leads to Monrovia, a relaxed city that stretches up into the San Gabriel Mountains. White picket fences and picture-perfect bungalows make it a popular filming location, but of the 28 single-family homes currently on the market, roughly half are listed for more than $1 million.

However, homeownership is also high, with 70.4% of residents owning their homes. California's homeownership rate is the second-lowest in the nation and the lowest among states, with only 54.2% of residents owning their homes. The state is notorious for its high housing costs, especially in the San Francisco and Los Angeles areas.

While the state’s home prices have grown at about the same rate as the country’s (38% vs. 36%), mortgage payments require a far lower percentage of income in Oklahoma (25% vs. 39%). We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The typical home in Wisconsin is valued at $279,390, and with a median income near the national median, the state boasts an above-average income-to-home-value ratio. West Virginia is the most affordable state to buy a house in, thanks to the typical house there costing just 45% of the typical U.S. house. The income-to-house-price ratio in West Virginia is the highest in the country.

Washington’s high median home price of $602,000 stems from Seattle’s tech boom, which has driven up wages and home prices, pushing many residents out to lower-cost parts of the state. One example is Spokane, where the median home sale price increased from $185,000 in May 2015 to $371,500 in September 2023. The price of a typical home in Tennessee is $304,617, 89% of the typical U.S. home value. A median household income that is 87% of the national median offsets those low housing costs and results in a below average income-to-home-value ratio. Mortgage rates fell significantly in 2020, driving up demand as home buyers looked to take advantage.

The architecture carries the same vibe, and most homes on the market resemble a cabin getaway in Big Bear. A five-acre compound complete with a 2,000-square-foot home and 700-vine vineyard has surfaced for sale in Pioneertown for $2 million. A mainstay on those “Best Places to Live” lists, Monterey Park offers a suburban lifestyle in the San Gabriel Valley. In addition to serving as the home of 35,000-student East Los Angeles College, it offers a variety of houses listed between $700,000 and $1 million. Industry-specific and extensively researched technical data (partially from exclusive partnerships). Mortgage rates will vary by loan type and term—for example, a 30-year fixed-rate FHA loan will have a different rate than a 15-year conventional loan.

No comments:

Post a Comment